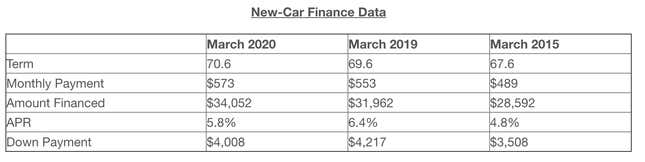

No one is buying new cars anymore, but many of those that did in March financed a scarily large amount of their purchase, in addition to stretching repayment over an average of nearly six years. This isn’t great!

Those two nuggets are in a new report from Edmunds, which analyzed its own data and made this startling graph. Edmunds says it’s the first time loan terms have averaged over 70 months in a single month.

The length of the loan jumps out at me, but almost more is the amount financed, over $5,000 more than five years ago, when the economy wasn’t in the midst of being wrecked by a terrifying virus. Over $34,000 reflects the fact that people prefer big trucks and big SUVs these days, more so than back then, but heading into what will likely be a recession, $34,000 is a hell of a lot of money for anyone to take on, especially on a vehicle that will depreciate as soon as you drive off the lot.

That number might get even bigger in April, since many automakers are offering zero-interest loans in the wake of coronavirus, but those apparently haven’t been very persuasive so far.

From Edmunds:

Edmunds data reveals that the share of sales with 0% finance deals saw a slight uptick in March, constituting 4.7% of new vehicle purchases compared to 3.6% in February.

“Automakers reacted quickly to the coronavirus crisis with attractive incentive offers and payment programs, but these unfortunately appeared to fall on deaf ears,” said Jessica Caldwell, executive director of insights at Edmunds. “Consumers were understandably distracted by the rapidly changing news cycle and changes to everyday life created by shelter-in-place orders, and March sales took a blow.”

The fact that zero interest hasn’t moved a huge bunch of people to go running to showrooms (so far) makes a certain amount of intuitive sense, since in some states showrooms are closed altogether, in addition to the fact that even if a loan carries no interest it can still amount to a big payment. And if that big payment is a big chunk of your income, that’s not really a good deal at all.

Personal finance types will tell you that your car payment should be 10 percent or less of your income, but whatever you do try not to be in this latter group:

Ten percent or higher! On a new car! Just thinking about that is giving me stress.