The Dodge Challenger is very, very old, but it doesn’t matter. For the very first time since the car emerged for the 2008 model year, Dodge has sold more Challengers than Ford and Chevrolet have sold Mustangs and Camaros.

Some will chalk that up to the chip shortage, and it’s quite possible Dodge and its dealer network have responded better to it than its crosstown rivals, as brand CEO Tim Kuniskis recently suggested to Automotive News in an interview. But to Stellantis’ own credit, the Challenger’s ascendance relative to the competition has been a trend for roughly half a decade now. The Mustang and Camaro have only slid in sales since 2015, when Ford’s numbers peaked. Incidentally, 2015 was the year the current-gen Mustang hit the market.

Ford shifted 122,349 Mustangs in 2015 while Dodge moved barely more than half of that amount — 66,377 Challengers. Last year, 54,314 Challengers rolled off dealer lots, compared to 52,414 Mustangs. Meanwhile the Camaro languished far behind, at 21,893.

Kuniskis is adamant that being the segment leader is not Dodge’s aim, but rather a welcome prize for weathering the supply chain storm, and a sign his team is in tune with what muscle car customers want: a sense of community, supposedly.

The Challenger’s uniqueness, he said, has been a driver of its staying power in the market. The speedster is “not trying to follow anybody else,” Kuniskis said.

“That’s why I said we don’t wake up trying to chase Mustang and Camaro,” he told Automotive News. “Not that I don’t think they’re viable competitors. They’re phenomenal cars; they’re just different cars. They’re different than what we’re trying to do.”

How is the Challenger different? Kuniskis doesn’t really elaborate, but John Grant, owner of Sahara Chrysler-Dodge-Jeep-Ram in Las Vegas, seems to get close to an answer:

Las Vegas dealer John Grant said it was great to outsell the Mustang, but he knows that wasn’t the ultimate motive for Dodge. Grant said Kuniskis has been committed to feeding product to the “Dodge family” of enthusiasts and building relationships with them.

“All of a sudden, we had to figure out how do we sell the incoming ones, and people like that,” Grant said. “People like ordering them, and [for] that Dodge Challenger, you can change the seats and the motor and the colors. The customer base has just embraced that.”

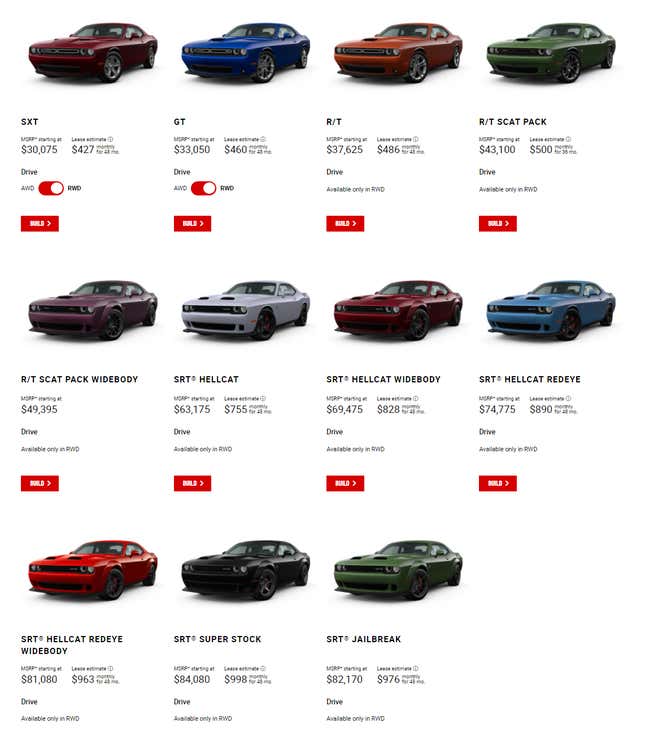

The Challenger is sort of like the snowflake of the car world — not in the pejorative parlance your uncle on Facebook is familiar with, but in the inspirational-quote sense. No two are alike. I’ve never been to a Challenger owners meet, but I imagine they look like Skittles from above, strewn about the asphalt in an assortment of hues with unique graphics and all manner of hood scoop patterns, some with flared fenders and others without. Take a glimpse at the Challenger’s build-and-price site, and there are no less than 11 different trim packages, each with its own name, listed for sale:

There aren’t quite as many Mustang or Camaro flavors. And in the Camaro’s case they follow GM’s exhilarating naming scheme — different combinations of a number with the letter “L,” “T” and “S,” for those feeling particularly sporty. That doesn’t quite ring a bell the way “R/T Scat Pack” does, let’s be honest.

That’s not to say the fancier packages are what most Challenger buyers leave the lot with. An owner of a different CDJR dealership confirmed as much in the article, though he also said the Scat Pack is gaining steam:

Huntington Beach Chrysler-Dodge-Jeep-Ram in Southern California was the top-selling Dodge store in the U.S. last year. General Manager Mike Harrington said the Challenger’s V-6-powered GT variant has been the volume leader, with a starting price just under $35,000. But he said the more powerful Scat Pack model has been turning the fastest.

I have no pony — sorry — in this race, but I will commend Dodge for doing the most with the oldest. The Challenger only has two years left, tops, and I have a feeling the 2024 run will set sales records as people try to snap up the very last of the ICE muscle car breed. If the supply chain allows Stellantis to build enough of them, that is.